Doji Candle: Understanding the Signals in Trading – The world of trading is replete with various indicators and signals that aid investors and traders in making informed decisions. Among these signals, the Doji candle holds a significant place due to its unique characteristics and the insights it offers into market sentiment and potential reversals.

Introduction to Doji Candle

Doji candles are a type of candlestick pattern formed when the opening and closing prices of an asset are virtually the same or very close, resulting in a very small body with long wicks. Originating from Japanese candlestick charting, Doji candles indicate indecision in the market and are crucial in technical analysis.

Historically, the Doji candle has been attributed to the rice markets of feudal Japan, where traders used candlestick patterns to predict future price movements.

Types of Doji Candles

There are several variations of Doji candles, each with its unique characteristics:

- Gravestone Doji: This Doji has a long upper shadow, indicating bearish reversal potential.

- Dragonfly Doji: It has a long lower shadow, suggesting bullish reversal potential.

- Long-Legged Doji: Exhibits higher volatility and indecision.

- Four-Price Doji: Extremely rare, occurs when the opening, closing, high, and low prices are the same.

Interpreting Doji Candles in Trading

Traders interpret Doji candles to understand market sentiment and potential trend reversals. The appearance of a Doji amidst a trend often signals a possible reversal or a significant shift in the balance between buyers and sellers. This candle, when combined with other technical analysis tools, can provide a clearer picture of market conditions.

Factors Influencing Doji Formation

Several factors contribute to the formation of Doji candles, including market volatility, trading volume, and price action. High volatility often leads to more frequent Doji formations, while low volume might diminish their significance.

Doji Candles in Technical Analysis

In technical analysis, traders develop strategies around Doji candles. These strategies involve identifying Doji formations within chart patterns or at key support and resistance levels, allowing traders to make more informed decisions.

Common Misinterpretations and Pitfalls

Despite their usefulness, traders often fall into the trap of over-relying on Doji signals. It’s essential to consider other indicators and market conditions to avoid misjudging potential price movements.

Using Doji Candles in Risk Management

Integrating Doji signals into risk management strategies involves setting stop losses and take profits based on the patterns observed, mitigating potential losses and maximizing gains.

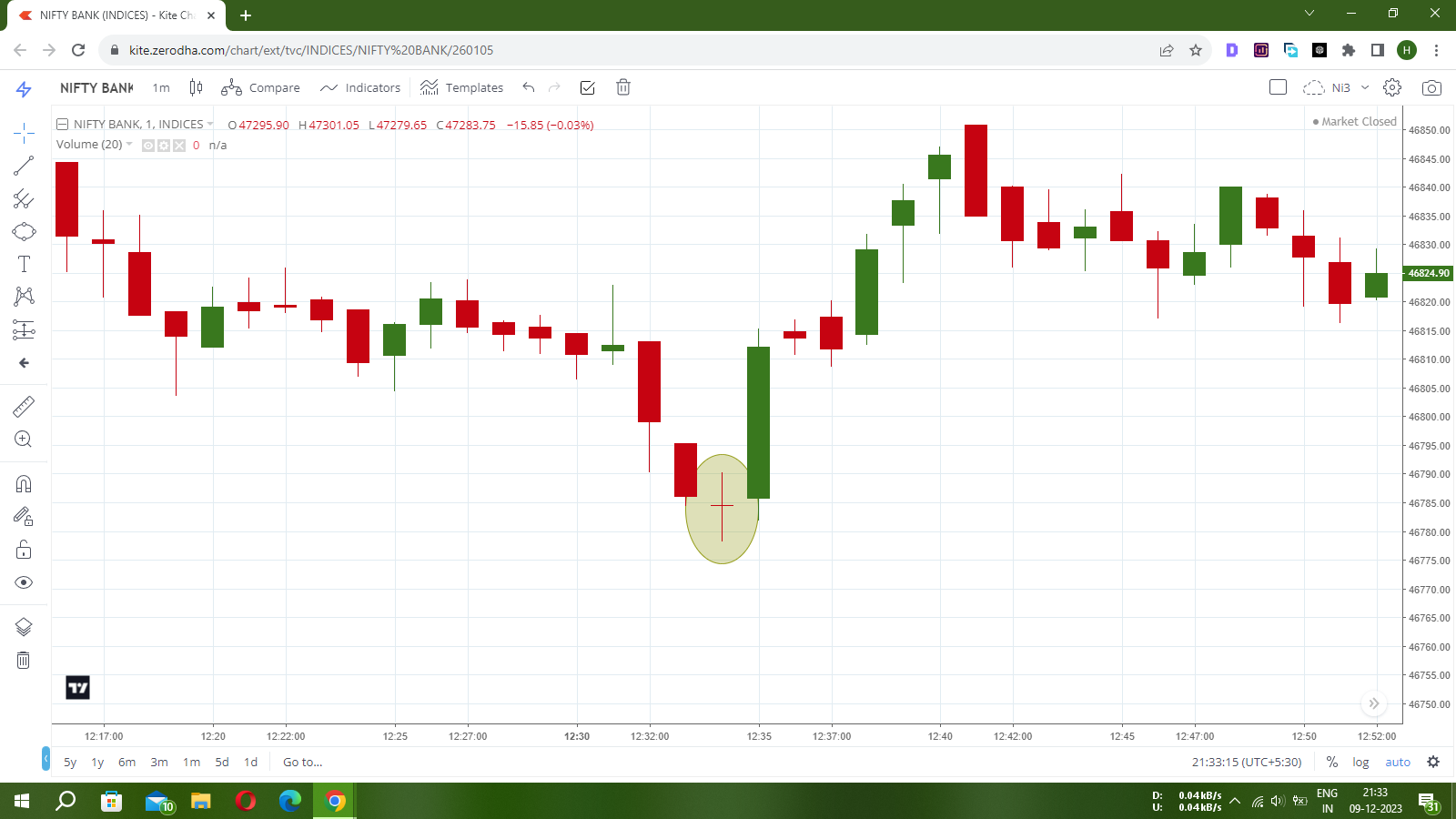

Real-world Examples of Doji Candle Patterns

Chart illustrations showcasing Doji candle patterns in various markets offer practical insights into how these patterns manifest and their implications for traders.

Doji Candle Patterns in Various Markets

Doji candles are observed across multiple markets, including forex, stocks, and cryptocurrency. Their interpretation might vary slightly based on the asset class being analyzed.

The Future of Doji Candles in Trading

As trading methodologies evolve, the significance of Doji candles might adapt and grow, potentially becoming an even more integral part of technical analysis tools.

Conclusion

Doji candles, with their unique characteristics, offer traders valuable insights into market sentiment and potential trend reversals. However, their effectiveness lies in their integration with other technical indicators and a holistic analysis of market conditions.

FAQs

- Are Doji candles always indicative of a trend reversal?

- Doji candles signal indecision; their effectiveness in predicting reversals depends on the context and confirmation from other indicators.

- How often do Doji candles appear in trading charts?

- The frequency of Doji candles varies based on market conditions and volatility.

- Can Doji candles be used as standalone indicators for trading decisions?

- It’s advisable to combine Doji signals with other technical analysis tools for more accurate predictions.

- Do all Doji candle patterns have the same significance?

- Different Doji patterns have varying levels of significance based on their formations and accompanying market conditions.

- Do Doji candles guarantee profits if identified correctly?

- While they provide valuable insights, there are no guarantees in trading. Proper risk management is crucial.