Dow Jones Industrial Average Today: A Comprehensive Insight – The Dow Jones Industrial Average (DJIA) stands tall as one of the oldest and most esteemed stock market indices globally. It serves as a beacon, guiding investors and financial enthusiasts through the ebb and flow of the market. This article delves into the intricacies of the DJIA, unraveling its significance, components, influencing factors, and impact on investments.

Introduction to the Dow Jones Industrial Average

The DJIA, often referred to simply as “the Dow,” is a composite index representing 30 major companies traded on the New York Stock Exchange and Nasdaq. Its origins date back to 1896 when Charles Dow created it, comprising primarily industrial stocks. Over time, its composition evolved, reflecting the changing landscape of the economy.

Understanding the Components

The 30 companies forming the DJIA are diverse, representing various sectors like technology, finance, healthcare, and consumer goods. Inclusion in this index isn’t arbitrary; companies must meet specific criteria, including sustained growth, financial viability, and overall reputation.

Factors Influencing the DJIA

The DJIA isn’t immune to market fluctuations. Economic indicators, geopolitical events, and global trends significantly impact its movements. From unemployment rates to GDP changes, each factor can sway the index’s direction.

How DJIA Impacts Investors

For investors, the DJIA isn’t just a number; it reflects market sentiment. Positive trends often boost confidence, prompting investments, while downturns can incite caution. trends like index investing or using the DJIA as a benchmark aid in making informed investment decisions.

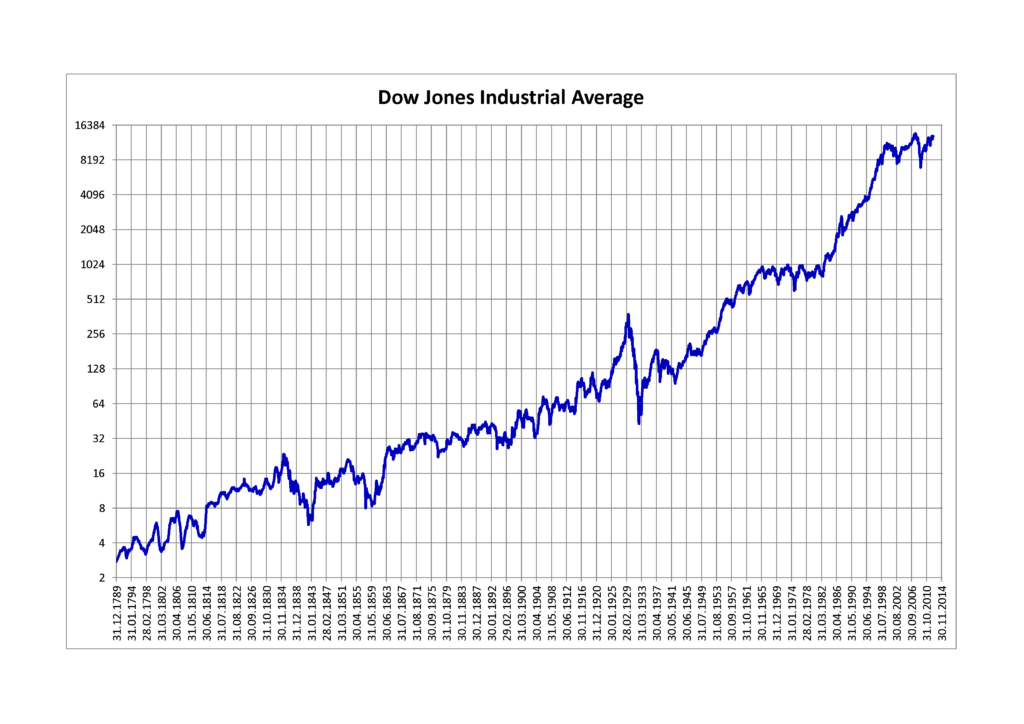

Analyzing DJIA Trends

Long-term and short-term trends in the DJIA paint a comprehensive picture of market movements. Recent performances, influenced by events like interest rate changes or geopolitical tensions, elucidate the index’s responsiveness to diverse factors.

Criticism and Limitations

While revered, the DJIA isn’t without criticisms. Some argue it’s a narrow representation of the market, focusing on only 30 companies. Alternative indices like the S&P 500 or Nasdaq offer broader perspectives, mitigating the DJIA’s limitations.

Conclusion

In essence, the DJIA remains a pivotal indicator of market performance, but it’s not the sole compass for investors. Understanding its intricacies, its strengths, and limitations helps in navigating the dynamic world of investments.

FAQs

- Is the DJIA the most important stock market index?

- The DJIA is influential, but other indices like the S&P 500 hold equal importance due to their broader scope.

- How often is the DJIA recalculated?

- The index is recalculated as needed, usually due to stock splits or other significant changes in member companies.

- Can individual investors directly invest in the DJIA?

- Investors can’t invest directly in the index, but they can invest in ETFs or mutual funds tracking it.

- Does the DJIA represent the entire stock market?

- No, it reflects 30 major companies and may not accurately depict the entire market’s performance.

- How does the DJIA impact the global economy?

- Being a prominent indicator, its movements often influence global market sentiments and investor confidence.