Morning Star Pattern – In the world of financial markets, understanding various candlestick patterns is essential for traders seeking profitable opportunities. Among these patterns, the Morning Star pattern stands out as a significant indicator, providing insights into potential market reversals and changes in trend directions.

Introduction to Candlestick Patterns

Candlestick patterns are graphical representations of price movements in financial markets. They showcase market sentiment, helping traders forecast potential price movements.

Understanding Morning Star Pattern

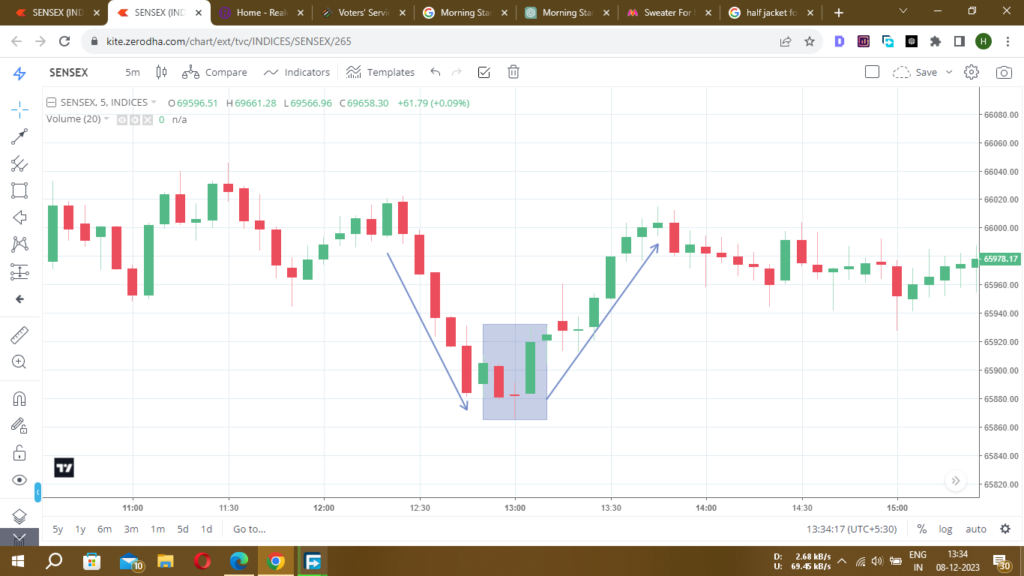

The Morning Star pattern is a three-candle bullish reversal pattern that usually occurs at the end of a downtrend. It consists of three candles: a long bearish candle, followed by a small-bodied candle with a gap down, and finally, a bullish candle that closes beyond the midpoint of the first candle.

Types of Morning Star Patterns

There are two types of Morning Star patterns: Bullish Morning Star, signaling a potential uptrend, and Bearish Morning Star, indicating a possible downtrend.

Identifying Morning Star Patterns

Identifying Morning Star patterns requires attention to detail. Traders often use technical analysis tools and chart patterns to confirm the validity of the pattern.

Trading Strategies using Morning Star Pattern

Traders incorporate the Morning Star pattern in various strategies, such as using it as a signal to enter or exit trades.

Benefits of Morning Star Patterns

The Morning Star pattern provides traders with valuable insights into potential market reversals and entry/exit points.

Common Mistakes when Identifying Morning Star Patterns

Misinterpreting patterns or false signals can lead to trading errors. Avoiding common mistakes is crucial for accurate analysis.

Real-life Examples of Morning Star Patterns

Examining real-life examples from the market provides practical insights into the effectiveness of the Morning Star pattern.

Comparison with Other Candlestick Patterns

Contrasting Morning Star patterns with similar candlestick patterns highlights their unique characteristics.

Advanced Tips for Morning Star Patterns

Experienced traders utilize advanced strategies and indicators to confirm Morning Star patterns.

Psychology Behind Morning Star Patterns

Understanding market sentiment and psychology is crucial when interpreting Morning Star patterns.

Risk Management with Morning Star Patterns

Implementing proper risk management strategies is essential when trading based on candlestick patterns.

Future Trends and Evolution of Morning Star Patterns

Predicting the future of Morning Star patterns involves considering market dynamics and evolving trends.

Case Studies and Testimonials

Real-life experiences and testimonials from traders demonstrate the practical application and success stories related to Morning Star patterns.

Conclusion

Morning Star patterns play a pivotal role in technical analysis, offering traders insights into potential market reversals and entry/exit points. Continual learning and application of these patterns contribute to successful trading strategies.

FAQs

- Q: How reliable are Morning Star patterns in trading?

- A: Morning Star patterns can be reliable, but confirmation with other indicators is advisable.

- Q: Can beginners easily identify Morning Star patterns?

- A: With practice and study, beginners can learn to recognize these patterns effectively.

- Q: Are Morning Star patterns guaranteed to predict market reversals?

- A: No pattern guarantees market movements, but Morning Star patterns offer valuable insights.

- Q: Can Morning Star patterns be used in multiple financial markets?

- A: Yes, these patterns are applicable across various financial markets.

- Q: Is it necessary to use Morning Star patterns alone for trading decisions?

- A: It’s beneficial to combine them with other indicators for more informed decisions.