Swing Trading Tips – Swing trading, a popular trading strategy, involves holding positions for several days to weeks, aiming to capture short-to-medium-term gains. Unlike day trading, swing trading allows traders to navigate market fluctuations without the constant monitoring required in day-to-day trading. Here’s a comprehensive guide packed with effective tips for mastering the art of swing trading.

Introduction to Swing Trading

Swing trading stands as a versatile strategy in the financial markets, striking a balance between long-term investments and short-term trading. Initially recognized in the stock market, swing trading has expanded its horizons to various assets like forex and cryptocurrencies. Its essence lies in capitalizing on price “swings” within an established trend.

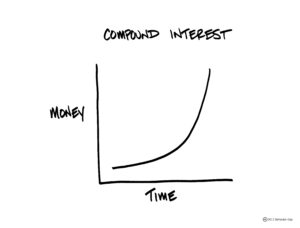

Benefits of Swing Trading

Swing trading offers flexibility and the potential for higher returns compared to traditional buy-and-hold strategies. Moreover, it minimizes exposure to overnight risks while leveraging short-term market movements for profit.

Key Principles of Successful Swing Trading

Success in swing trading hinges on clear goal-setting, comprehensive technical analysis, and prudent risk management strategies. Traders must establish concise entry and exit points, employing robust indicators and tools for informed decisions.

Choosing the Right Assets for Swing Trading

Selecting suitable assets involves understanding market conditions, liquidity, and volatility. Stocks, currencies, and cryptocurrencies all present distinct opportunities, requiring tailored strategies.

Developing a Swing Trading Strategy

Crafting a personalized strategy involves a blend of technical analysis, chart patterns, and risk management. Traders should focus on creating a method that aligns with their risk tolerance and financial goals.

Common Mistakes to Avoid in Swing Trading

Overtrading, ignoring fundamental analysis, and succumbing to emotional decisions can hinder success. Discipline and adherence to a trading plan mitigate these risks.

Learning Resources for Aspiring Swing Traders

Numerous resources, including books, courses, and online communities, aid in learning the intricacies of swing trading.

Tracking and Evaluating Performance

Maintaining meticulous records helps in analyzing performance and refining strategies for improved results.

Market Conditions and Timing in Swing Trading

Understanding market cycles and adapting strategies to bullish or bearish markets is crucial for success.

Managing Risks in Swing Trading

Proper position sizing, diversification, and utilizing stop-loss orders mitigate risks inherent in trading.

Psychology and Discipline in Swing Trading

Controlling emotions and adhering to a predetermined plan are vital for sustained success in swing trading.

Adapting to Changing Market Trends

Flexibility and the ability to adapt strategies to volatile markets are key traits of successful swing traders.

Case Studies and Success Stories in Swing Trading

Real-life examples showcase the effectiveness of swing trading strategies in different market scenarios.

Ethical Considerations in Swing Trading

Traders should practice responsible and ethical trading, considering the impact of their actions on markets.

Conclusion

Swing trading provides ample opportunities for traders seeking short-to-medium-term gains. By understanding market dynamics, employing effective strategies, and staying disciplined, aspiring swing traders can navigate the financial markets successfully.

FAQs

- What capital is required for swing trading?

- Can swing trading be automated?

- How do I handle losing trades in swing trading?

- Is swing trading suitable for beginners?

- How often should I review my swing trading strategy?