Understanding Day Trading Risk-Reward Ratio – Day trading involves making quick decisions in the financial markets to capitalize on short-term price movements. However, this high-speed trading strategy also carries inherent risks. One crucial aspect that traders must grasp is the risk-reward ratio, which serves as a guiding principle in mitigating risks and maximizing returns.

Introduction to Day Trading

Day trading is a trading approach where positions are opened and closed within the same trading day. It requires a deep understanding of market trends, technical analysis, and the ability to act swiftly.

Explaining Risk-Reward Ratio

Definition and Importance

The risk-reward ratio is the relationship between the potential loss and gain of a trade. It’s a pivotal factor that helps traders assess the profitability and risk exposure of their trades before execution.

Calculating Risk-Reward Ratio

Formula and Components

The risk-reward ratio formula involves dividing the potential reward by the potential risk. Traders typically aim for a ratio that ensures the potential reward outweighs the risk.

Significance in Day Trading Strategies

Risk Management Principles

Maintaining a favorable risk-reward ratio is fundamental in effective risk management. It assists traders in preserving capital while aiming for profitable outcomes.

Strategies for Optimizing Risk-Reward Ratio

Setting Stop-Loss and Take-Profit Levels

Implementing predefined exit points, such as stop-loss and take-profit orders, helps in controlling losses and securing profits.

Scaling In and Out of Trades

Gradually entering and exiting trades allows traders to adjust positions based on market movements, optimizing the risk-reward ratio.

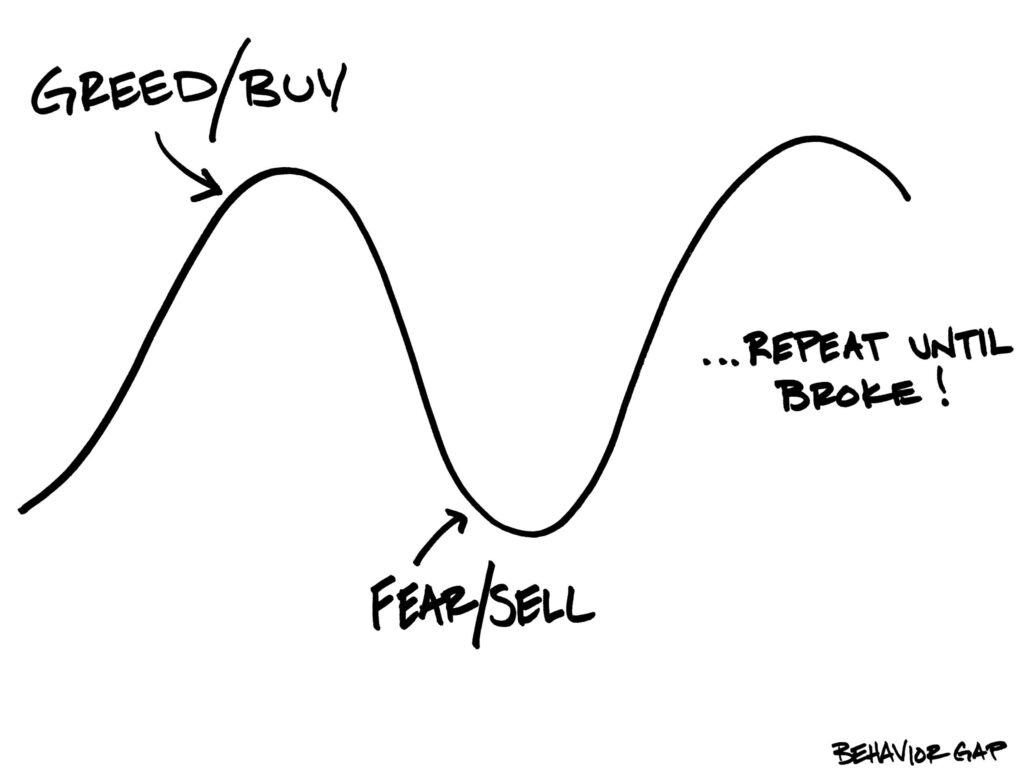

Psychological Impact on Risk-Reward Ratio

Emotions and Decision Making

Emotions can cloud judgment, leading to irrational decisions that can impact the risk-reward ratio. Maintaining discipline is crucial.

Case Studies and Examples

Real-life examples and case studies illustrate how different risk-reward ratios influence trading outcomes, providing practical insights.

Common Mistakes and How to Avoid Them

Understanding common errors, like chasing high risk-reward ratios without proper analysis, helps traders avoid detrimental pitfalls.

Tools and Resources for Risk-Reward Ratio Analysis

Utilizing various tools and resources, such as risk calculators and market analysis software, enhances the assessment of risk-reward ratios.

Incorporating Risk-Reward Ratio in Trading Plans

Integrating risk-reward ratios into comprehensive trading plans aids in strategizing and executing trades more effectively.

Expert Insights and Advice

Seasoned traders and experts share valuable tips and strategies for optimizing risk-reward ratios, based on their experiences.

Conclusion

Understanding and effectively managing the day trading risk-reward ratio is pivotal for achieving success in the volatile world of financial markets. Implementing robust strategies, utilizing tools, and controlling emotions are critical elements in this pursuit.

FAQs:

- What is a good risk-reward ratio in day trading?

- How do emotions impact the risk-reward ratio?

- Can you provide examples of optimizing risk-reward ratios?

- What tools can assist in analyzing risk-reward ratios?

- Why is setting stop-loss crucial for risk management in day trading?