Unlocking the Secrets: How the Dow Jones Predicts Market Trends – The Dow Jones industrial common, generally known as the Dow Jones or virtually the Dow, holds a respected status in the world of finance. It serves as a barometer for the fitness of the stock marketplace and is closely watched through investors, analysts, and economists alike. knowledge how the Dow Jones predicts market traits is fundamental to navigating the complexities of the financial panorama.

Unlocking the Secrets: How the Dow Jones Predicts Market Trends

History of the Dow Jones

The Dow Jones was established in 1896 by way of Charles Dow and Edward Jones with the purpose of supplying a photo of the overall performance of key business sectors in the u.s.. over time, it has evolved to consist of companies from numerous sectors, making it a comprehensive gauge of the broader marketplace.

Components of the Dow Jones

The Dow Jones includes 30 large publicly traded corporations selected with the aid of the editors of The Wall street journal. these businesses are leaders in their respective industries and are chosen based totally on various criteria such as marketplace capitalization, liquidity, and region illustration.

Calculation of the Dow Jones

Not like different market indices that use a weighted average primarily based on marketplace capitalization, the Dow Jones is calculated the use of a price-weighted methodology. this means that shares with higher fees have a more impact on the index’s moves. adjustments are made for stock splits, dividends, and different company movements to make certain the index stays correct.

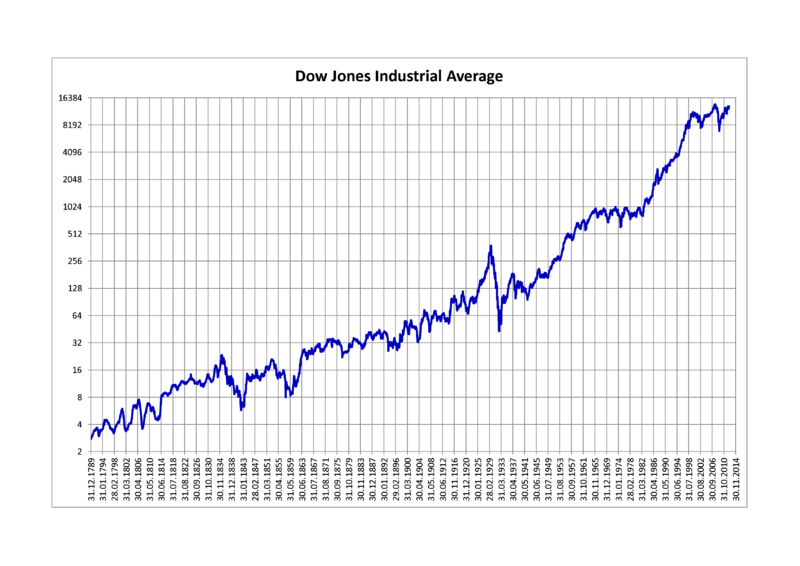

Relationship Between Dow Jones and Market Trends

The Dow Jones is carefully correlated with broader marketplace sentiment and serves as a leading indicator of monetary developments. actions within the index can impact investor conduct and offer valuable insights into the path of the economic system.

Leading Indicators and Dow Jones

Main indicators such as purchaser self belief, housing starts offevolved, and production activity can offer early signals of future economic traits. these indicators play a vital role in influencing the actions of the Dow Jones.

Technical Analysis and the Dow Jones

Technical evaluation includes the have a look at of beyond marketplace statistics to forecast future charge actions. not unusual indicators including transferring averages, relative electricity index (RSI), and Bollinger Bands are frequently utilized by traders to investigate the Dow Jones and discover ability traits.

Economic Indicators and Dow Jones Trends

Key financial signs consisting of gross home product (GDP), unemployment rates, and inflation figures can impact investor sentiment and have an effect on the route of the Dow Jones. expertise those indicators is crucial for predicting marketplace tendencies.

Expert Analysis and Dow Jones Predictions

Financial experts and analysts carefully screen the Dow Jones and use a combination of technical evaluation, economic data, and market sentiment to make predictions. whilst those forecasts can provide precious insights, they may be now not without obstacles and might every now and then be subject to interpretation.

Behavioral Finance and Dow Jones

Behavioral finance explores the psychological factors that have an effect on investor behavior and marketplace traits. Behavioral biases together with herd mentality, overconfidence, and loss aversion can impact the actions of the Dow Jones and contribute to market volatility.

Case Studies: Dow Jones Predictions

Analyzing beyond marketplace trends and historical records can offer valuable insights into the predictive energy of the Dow Jones. Case studies of successful predictions primarily based on Dow Jones actions offer treasured training for investors and analysts alike.

Challenges and Risks in Dow Jones Predictions

Whilst the Dow Jones can provide precious insights into marketplace tendencies, it isn’t without its demanding situations and dangers. Volatility, surprising activities, and overreliance on historical information can all pose great hurdles to accurate predictions.

Tools and Resources for Dow Jones Analysis

A extensive range of equipment and resources are available for reading the Dow Jones and predicting marketplace developments. From software program platforms to on-line databases, traders have get admission to to a wealth of records to useful resource in their decision-making procedure.

Strategies for Using Dow Jones Predictions

developing effective techniques for using Dow Jones predictions is vital for maximizing returns and managing hazard. whether planning for long-time period investments or executing quick-time period trades, having a well-described approach is key to fulfillment in the economic markets.

Conclusion

The Dow Jones plays a principal role in predicting marketplace trends and guiding investment choices. by using information the additives of the index, reading key indicators, and leveraging expert insights, buyers can advantage precious insights into the route of the economic system and make informed decisions.

Unique FAQs

- How regularly is the Dow Jones updated?

- The Dow Jones is up to date in real-time during the buying and selling day, reflecting modifications inside the fees of its thing shares.

- What elements can motive the Dow Jones to differ?

- Various factors which includes monetary statistics releases, geopolitical events, corporate profits reviews, and adjustments in investor sentiment can all affect the actions of the Dow Jones.

- Is the Dow Jones a reliable predictor of market developments?

- Whilst the Dow Jones can offer valuable insights into marketplace tendencies, it isn’t always infallible and ought to be used at the side of other signs and evaluation strategies.

- How can buyers use Dow Jones predictions to inform their funding selections?

- Buyers can use Dow Jones predictions to become aware of potential possibilities and dangers within the marketplace, adjust their funding portfolios consequently, and put into effect risk control techniques to shield their assets.

- Are there alternative indices to the Dow Jones for predicting market traits?

- Sure, there are several other marketplace indices inclusive of the S&P 500, Nasdaq Composite, and Russell 2000 that buyers can use in conjunction with or as options to the Dow Jones for predicting marketplace developments.