Bullish Engulfing: Unveiling a Powerful Candlestick Pattern – In the world of financial markets, understanding patterns and signals is pivotal for successful trading. Among these patterns, the bullish engulfing holds a significant place, characterized by its potential to indicate imminent market shifts and potential investment opportunities.

Introduction to Bullish Engulfing

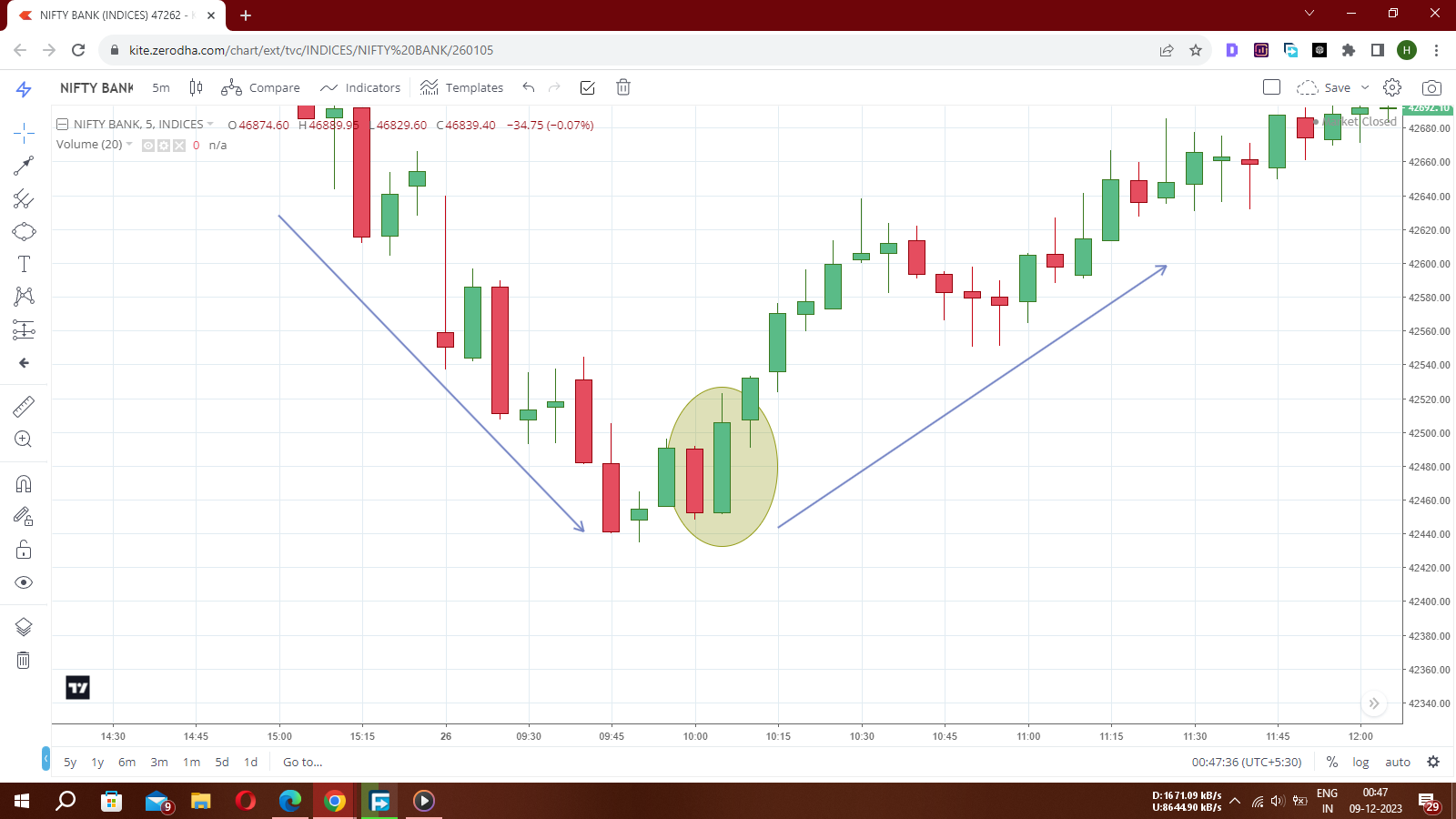

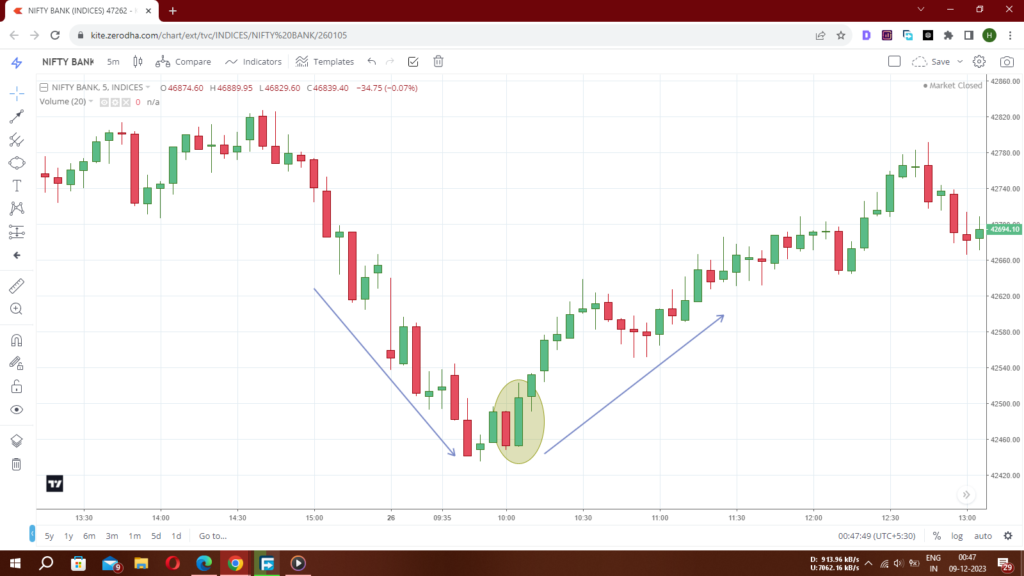

Candlestick patterns serve as visual indicators of market sentiment and price movement. Among these patterns, the bullish engulfing is a prominent formation that signifies a potential reversal of a downtrend into an uptrend.

Components of Bullish Engulfing

This pattern comprises two candles, where the second candle completely engulfs the body of the previous candle. The first candle typically represents a bearish market sentiment, followed by a bullish reversal indicated by the second candle’s dominance.

Significance in Technical Analysis

In technical analysis, identifying bullish engulfing on price charts is crucial. It often appears at the end of a downtrend, suggesting a possible upward shift in prices, making it a valuable tool for traders.

How to Trade Using Bullish Engulfing

Traders often use this pattern to make entry or exit decisions. However, it’s essential to combine it with other indicators and risk management strategies for effective trading.

Real-life Examples

Numerous instances exist where traders have capitalized on bullish engulfing. Case studies showcasing successful trades based on this pattern illustrate its practical application.

Common Mistakes and Misinterpretations

Despite its apparent simplicity, misidentifying or misinterpreting this pattern is common among traders, leading to flawed decisions.

Comparative Analysis with Other Patterns

Contrasting bullish engulfing with similar candlestick patterns helps in distinguishing its unique features and reliability.

Psychology Behind Bullish Engulfing

Understanding the psychology behind market sentiment driving this pattern aids in comprehending its significance.

Risk and Reward of Bullish Engulfing

While this pattern offers potential gains, understanding its associated risks is crucial for informed trading decisions.

Tips for Identifying Bullish Engulfing

Utilizing tools and techniques to spot this pattern accurately enhances its effectiveness in trading strategies.

Adapting Bullish Engulfing in Diverse Markets

This pattern’s application is not limited to a specific market; it can be adapted across various financial sectors with necessary adjustments.

Historical Success Rates

Analyzing historical data reveals the effectiveness of bullish engulfing and its reliability over time.

Educational Resources for Learning Bullish Engulfing

Numerous educational materials exist to deepen one’s understanding of this pattern, aiding traders in mastering its application.

Future Outlook of Bullish Engulfing

As trading methodologies evolve, the future of bullish engulfing may witness modifications or adaptations, impacting its relevance.

Conclusion

In conclusion, understanding and effectively using bullish engulfing can significantly enhance a trader’s decision-making process in financial markets. Its ability to signal potential reversals and its adaptability across various market conditions make it a valuable tool for traders.

FAQs:

- Is bullish engulfing a guaranteed indicator of market reversal?

- Can bullish engulfing be used in combination with other technical analysis tools?

- Are there instances where bullish engulfing fails to predict market shifts?

- Does the timeframe affect the reliability of bullish engulfing?

- How can beginners learn to identify bullish engulfing effectively?