Hammer Candlestick: Understanding and Utilizing This Powerful Trading Signal – Investing in the financial markets involves understanding various technical analysis tools. Among these tools, the hammer candlestick stands out for its potential to signal crucial market reversals. This article aims to delve into the intricacies of hammer candlesticks, providing insights into their anatomy, significance in trading, identification, strategies for application, limitations, real-world examples, and tips for effective use.

Introduction to Hammer Candlestick

The hammer candlestick holds significance in the realm of technical analysis. Its unique shape and position within a price chart make it a crucial indicator for traders. Originating from Japanese candlestick charting, the hammer signifies a potential trend reversal.

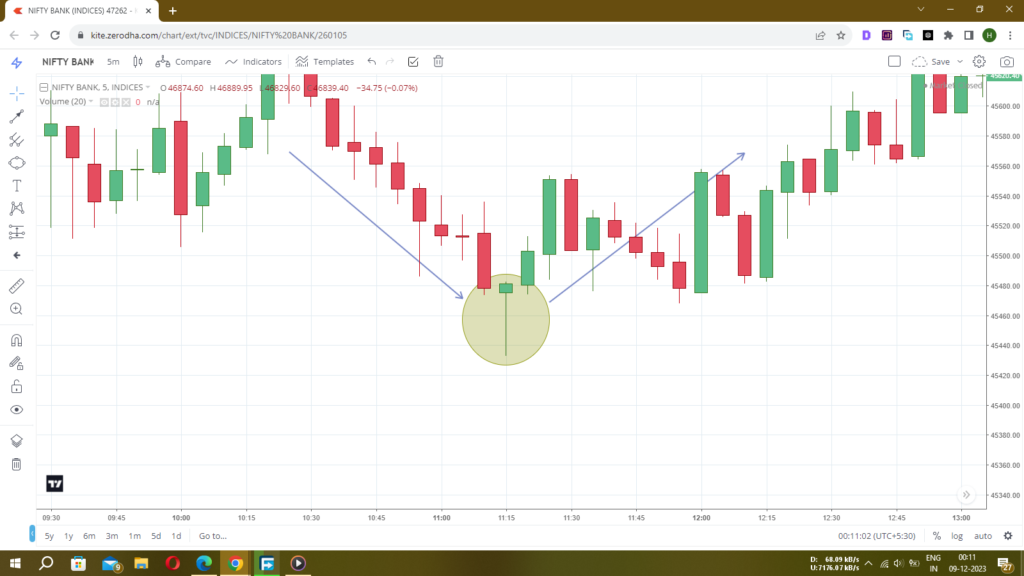

Anatomy of a Hammer Candlestick

Understanding the anatomy of a hammer candlestick is fundamental. Typically characterized by a small body and a long lower shadow, it reflects a market reversal, particularly when observed after a downtrend. Variations such as inverted hammers and shooting stars add depth to its interpretation.

Understanding the Significance

Interpreting the hammer candlestick in trading involves recognizing its bullish reversal implications. The shape and position within a chart provide insights into potential shifts in market sentiment, guiding traders towards profitable decisions.

IV. Identifying Hammer Candlesticks

Spotting hammer candlesticks amidst a multitude of chart patterns requires keen observation. Analyzing chart formations and recognizing these patterns assist traders in making informed decisions based on the signals provided by hammers.

Strategies Incorporating Hammer Candlesticks

Incorporating hammer candlesticks into trading strategies involves understanding their role in decision-making. Strategies that leverage these signals encompass risk management and maximizing profit potential.

Limitations and Considerations

Despite their usefulness, hammer candlesticks are not foolproof. Instances of false signals and factors affecting their accuracy necessitate a cautious approach and supplementary analysis.

Real-world Examples and Case Studies

Examining real-world scenarios where hammer candlesticks have led to successful trades or failed predictions sheds light on their application in practical trading situations. Learning from both successes and failures enhances traders’ abilities to use these signals effectively.

Tips for Effective Use

To utilize hammer candlesticks optimally, traders should follow best practices and avoid common mistakes. Incorporating these tips enhances the accuracy of their analysis and decision-making.

Conclusion

In conclusion, the hammer candlestick serves as a valuable tool in the arsenal of technical analysis for traders. Its interpretation, application, and limitations underscore its significance in guiding investment decisions.

FAQs about Hammer Candlestick:

- What is the significance of the hammer candlestick in trading?

- How accurate are hammer candlestick signals?

- Are there variations of hammer candlesticks that traders should be aware of?

- Can hammer candlesticks be used in different timeframes for trading?

- What precautions should traders take when relying on hammer candlestick signals?