Trading Mechanism Strategies – In the world of finance and investments, trading mechanisms are the backbone of successful transactions. Understanding different trading strategies and implementing them effectively can significantly impact your investment journey. In this article, we will explore various trading mechanism strategies that can help you navigate the complex world of trading with confidence and proficiency.

Trading mechanisms are the tools and techniques used to facilitate the buying and selling of financial instruments in the global markets. These mechanisms provide structure and efficiency to the trading process, ensuring that transactions are executed smoothly and fairly.

What are Trading Mechanisms?

Trading mechanisms encompass a wide range of processes, including order execution, price determination, and trade settlement. These mechanisms can vary depending on the type of financial instrument being traded and the specific market in which the transaction takes place.

The Role of Trading Mechanisms in Financial Markets

Trading mechanisms play a crucial role in maintaining market liquidity and promoting price discovery. They provide investors with opportunities to buy and sell assets at competitive prices, ensuring the continuous flow of capital in the financial markets.

Types of Trading Mechanisms

Market Orders

Market orders are the simplest type of orders, instructing brokers to execute trades immediately at the prevailing market price. They are ideal for investors who prioritize quick execution over price control.

Limit Orders

Limit orders allow investors to set specific price levels at which they are willing to buy or sell an asset. These orders offer more control over the trade execution price but may not guarantee immediate execution.

Stop Orders

Stop orders are designed to limit losses and protect profits. They are activated when the asset’s price reaches a predetermined level, triggering a market order.

Day Trading

Day trading involves buying and selling financial instruments within the same trading day. Day traders aim to capitalize on intraday price movements.

Swing Trading

Swing trading focuses on holding positions for several days or weeks to benefit from medium-term price swings.

Position Trading

Position traders take a long-term approach, holding positions for months or even years, based on fundamental and technical analysis.

Algorithmic Trading

Algorithmic trading relies on computer programs to execute trades based on predefined criteria, such as price, volume, or market conditions.

Technical Analysis in Trading

Candlestick Patterns

Candlestick patterns are graphical representations of price movements and provide insights into potential trend reversals and continuations.

Support and Resistance Levels

Support and resistance levels indicate price zones where an asset’s price may encounter barriers.

Moving Averages

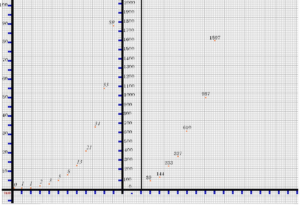

Moving averages smooth out price data to identify trends over specific time periods.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements.

Fibonacci Retracement

Fibonacci retracement levels help identify potential support and resistance levels based on the Fibonacci sequence.

Fundamental Analysis in Trading

Economic Indicators

Economic indicators, such as GDP, inflation rates, and employment data, provide insights into a country’s economic health.

Financial Statements

Analyzing a company’s financial statements can offer valuable information about its financial performance and health.

Industry and Company Analysis

Understanding the industry and company-specific factors can help investors make informed decisions.

Combining Technical and Fundamental Analysis

Finding Confluence Points

By combining technical and fundamental analysis, traders can identify confluence points that increase the probability of successful trades.

Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders and position sizing, is crucial for long-term trading success.

Risk Management in Trading

Setting Stop-Loss Orders

Stop-loss orders are essential tools for limiting potential losses on trades.

Position Sizing

Proper position sizing ensures that no single trade significantly impacts the overall portfolio.

Diversification

Diversifying investments across different assets helps reduce risk exposure.

Emotional Discipline and Trading Psychology

Controlling Fear and Greed

Emotional discipline is essential to prevent impulsive decisions driven by fear or greed.

Maintaining a Trading Journal

Keeping a trading journal helps analyze past trades and improve future decision-making.

The Role of News and Market Sentiment

Impact of News on Financial Markets

News events can trigger significant price movements, presenting both opportunities and risks.

Using Market Sentiment to Your Advantage

Market sentiment reflects the overall attitude of investors towards a particular asset or market.

Developing a Trading Plan

Defining Goals and Objectives

Having clear trading goals and objectives helps maintain focus and discipline.

Creating a Trading Strategy

A well-defined trading strategy outlines the rules and criteria for executing trades.

Backtesting and Optimization

Backtesting historical data helps assess the effectiveness of a trading strategy.

Choosing a Suitable Brokerage

Factors to Consider When Selecting a Brokerage

Selecting the right brokerage is crucial for a smooth trading experience.

Types of Brokerage Accounts

Different types of brokerage accounts cater to various investor needs.

Common Trading Mistakes to Avoid

Overtrading

Overtrading can lead to excessive transaction costs and potential losses.

Chasing Losses

Chasing losses can result in emotional decision-making and further losses.

Lack of Patience

Patience is vital in trading to wait for the right opportunities.

Keeping Up with Market Trends

Continuous Learning and Improvement

Staying updated with market trends and continuously learning are essential for adapting to changing market conditions.

Psychology of Winning and Losing

Maintaining a Healthy Trading Mindset

Maintaining a positive and disciplined mindset is crucial to handle both winning and losing trades.

Trading Mechanism Strategies for Cryptocurrencies

Volatility and Risk Factors

Trading cryptocurrencies requires an understanding of their unique characteristics, such as high volatility and risk factors.

Conclusion

In conclusion, mastering trading mechanism strategies is vital for success in the financial markets. Understanding different trading mechanisms, combining technical and fundamental analysis, implementing risk management, and maintaining emotional discipline are all essential components of a successful trading journey.

FAQs

- Is day trading suitable for beginners?

- Day trading can be challenging for beginners due to its fast-paced nature and higher risk. It is advisable to start with swing or position trading and gain experience before attempting day trading.

- What percentage of my portfolio should I risk per trade?

- The percentage of portfolio risk per trade depends on your risk tolerance and trading strategy. As a general rule, it is recommended not to risk more than 1-2% of your total portfolio on any single trade.

- Can I use both technical and fundamental analysis together?

- Yes, combining technical and fundamental analysis can provide a more comprehensive view of the market and increase the likelihood of successful trades.

- How can I control my emotions while trading?

- Is trading cryptocurrencies riskier than traditional assets?

- Yes, cryptocurrencies are known for their high volatility, making them riskier than traditional assets. Proper risk management is crucial when trading cryptocurrencies.